Here is a structured overview of Mavia Coin (MAVIA) price predictions for 2025, including key factors that could influence its value. Note that cryptocurrency markets are highly speculative, and this analysis is for informational purposes only – not financial advice.

What is Mavia Coin (MAVIA)?

- Project: MAVIA is the native token of Heroes of Mavia, a blockchain-based play-to-earn (P2E) strategy game where players build armies, compete, and earn rewards.

- Use Case: Used for in-game purchases, staking, governance, and trading assets on the Mavia Marketplace.

- Blockchain: Built on Ethereum (ERC-20 standard) with plans for cross-chain compatibility.

Key factors influencing MAVIA price in 2025

1. Game adoption

- Success depends on player growth, partnerships, and updates (e.g., new features, maps, or NFTs).

- A thriving ecosystem could drive demand for MAVIA tokens.

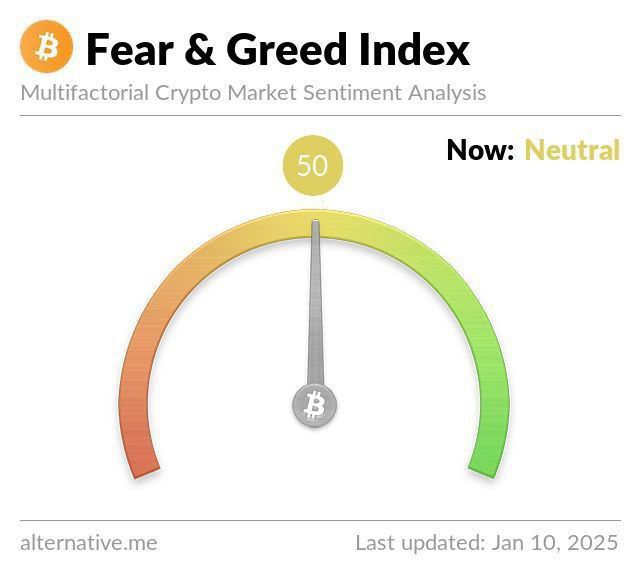

2. Crypto market sentiment

- A bullish market (e.g., Bitcoin ETF approval, institutional adoption) could lift MAVIA.

- Bearish trends or regulatory action could suppress prices.

3. Tokenomics

- Maximum supply: 500 million MAVIA (by 2023).

- Circulating supply, burns, or staking rewards will impact scarcity and price.

4. Competition

- Competitive P2E games (e.g., Axie Infinity, Illuvium) could divert user attention.

5. Regulatory Environment

- Global regulation on crypto/P2E gaming may impact adoption (e.g., SEC actions, bans).

6. Technological Developments

- Scalability upgrades (e.g., layer-2 solutions) or security breaches may impact investor confidence.

MAVIA Price Prediction for 2025

Hypothetical scenarios based on current trends and adoption potential:

| Scenario | Price Range | Drivers |

|---|---|---|

| Bullish Case | $5 – $15 | – Growth of viral games. – Major exchange listings. – Crypto bull market. |

| Moderate Case | $2 – $5 | – Steady user growth. – Stable crypto market. – Regular updates. |

| Bearish Case | $0.50 – $1.50 | – Low acceptance. – Regulatory hurdles. – Market decline. |

Recent Trends (2023-2024)

- 2023 Performance: MAVIA launched at ~$0.10, rose to ~$3 during initial hype, then stabilized near $1.

- 2024: Price fluctuated with broader market trends (e.g., Bitcoin halving, Ethereum upgrade).

Baby Doge Coin: Hype or Hidden Gem? An In-Depth Analysis

Risks and Considerations

- Volatility: Crypto prices can fluctuate dramatically.

- Dependency on Game Success: If Heroes of Mavia fails to retain players, MAVIA’s value may decrease.

- Regulatory uncertainty: P2E games face scrutiny in certain regions (e.g., Southeast Asia, EU).

- Conclusion

MAVIA’s 2025 price will depend on game adoption, token utility, and broader market conditions. While optimistic forecasts suggest a rise to $10+, always do your own research (DYOR) and invest with caution. Track updates from the Mavia team and monitor crypto market trends.

Disclaimer: This is not financial advice. Cryptocurrencies are high-risk assets.