Trump Coin refers to a type of cryptocurrency inspired by former U.S. President Donald Trump. This particular niche within the crypto world has stirred up quite a bit of discussion. Often seen as memecoins or politically focused projects, these tokens utilize Trump’s controversial image to attract investors and engage various online communities. Although there’s no official cryptocurrency endorsed by Trump (who has shown skepticism towards Bitcoin and Ethereum), numerous independent projects have taken his name, phrases, and pictures. This overview will look into the background, functioning, risks, and cultural relevance of these Trump-themed cryptocurrencies

1. Background and Growth

These cryptocurrencies first appeared in 2016 with the introduction of TrumpCoin (TRUMP), a Bitcoin offshoot created to back his presidential run. This early attempt aimed to be a decentralized payment method reflecting conservative principles. However, due to a lack of technical progress and uncertain regulations, it never caught on widely.

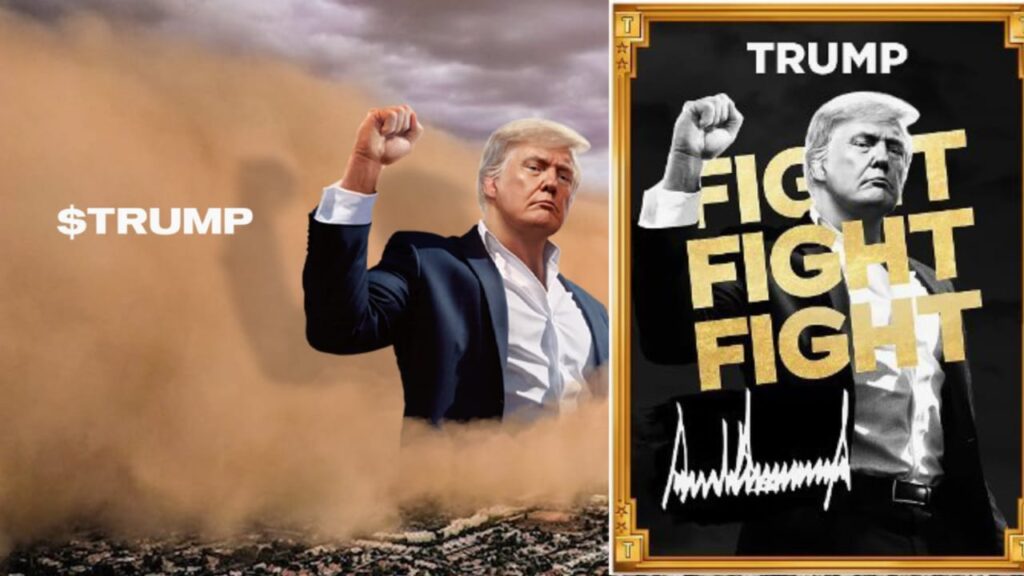

Interest in these coins re-emerged during the 2020 surge of memecoins, leading to projects like MAGA Coin (TRUMP) on Ethereum and a new TrumpCoin (TRUMP) on Binance Smart Chain (BSC). These later versions shifted away from serious payment systems, embracing meme culture and speculative trading instead. Their popularity grew alongside Trump’s activities after his presidency, including his NFTs and criticism of big tech, which energized his supporters.

2. Common Traits and Structure

Trump coins have some shared features:

A. Branding and Symbolism

Slogans: These tokens often use catchy phrases like “Make America Great Again” (MAGA), “America First,” or “Trump 2024.”

Visuals: Many logos depict Trump’s face, the American flag, or conservative symbols like eagles and red caps.

B. Token Structure

Supply: Most have very large supplies (often in the billions or trillions) to facilitate small transactions and trading.

Fees and Distribution: Many charge a transaction fee (usually between 5-10%) that funds:

Liquidity pools to help stabilize prices,

Rewards for holders through reflection mechanisms,

Donations to charities (like veterans’ organizations or conservative causes).

Burning Tokens: Some projects periodically destroy a portion of their tokens to create scarcity.

C. Community and Decision-Making

Decentralized Voting: Token holders might participate in decision-making through decentralized organizations (DAOs), although real governance structures are often lacking.

Social Media Engagement: Groups on platforms like Telegram, Twitter (X), and Truth Social engage users with memes, polls, and speculation regarding Trump’s support.

3. Technology and Platforms

The technology behind Trump coins varies:

A. Blockchain Options

Bitcoin Fork (TrumpCoin 2016): This operated on a modified Bitcoin blockchain using Proof-of-Work (PoW) but struggled with functionality, leading to its decline.

Ethereum (ERC-20): Coins like MAGA Coin utilize Ethereum’s smart contracts for staking and trading, though high fees can be a barrier for smaller investors.

Binance Smart Chain (BEP-20): This platform offers low-cost, fast transactions, making it popular for Trump-themed memecoins.

B. Smart Contract Features

Automatic Rewards: Some tokens give out rewards based on trading activity automatically.

Transaction Limits: Many impose size limits on transactions to prevent large holders from affecting prices.

Security Audits: A few undergo third-party checks to ensure security, but many skip this to save money.

4. Market Behavior and Fluctuations

Trump coins are known for their speculative nature and respond strongly to political events:

A. Price Swings

Surges from Events: Prices can skyrocket with news related to Trump, like campaign announcements or NFT releases. For instance, his announcement for the 2024 election led to some tokens jumping in value by 200-300%.

Hype Dependency: Unlike Bitcoin or Ethereum, Trump coins don’t have inherent value, so they can drop quickly when excitement wanes.

B. Trading Environment

DEX Trading: Most Trump coins are traded on decentralized exchanges like Uniswap (Ethereum) and PancakeSwap (BSC), where liquidity can be low.

CEX Listings: A few tokens, like MAGA Coin, show up on smaller centralized exchanges (like BitMart), but larger ones like Coinbase often avoid them due to regulatory risks.

C. Market Size

Many Trump-themed coins have market caps under $100 million, with quite a few below $10 million, making them vulnerable to manipulation and quick rises and falls in value.

5. Risks and Issues

Investing in Trump coins involves many risks:

A. No Official Support

Trump has not endorsed any cryptocurrency, in fact, he’s labeled Bitcoin “a scam” and favored the dollar. Projects that use his name may face legal issues or cease-and-desist orders for trademark violations.

B. Regulatory Concerns

SEC Attention: The U.S. Securities and Exchange Commission (SEC) might view these tokens as unregistered securities if they promise returns linked to team efforts.

Tax Considerations: The IRS sees memecoins as property, creating complex tax situations for traders.

C. Scams and Fraud

Rug Pulls: Developers sometimes leave projects suddenly after draining funds. In 2021, a Trump-themed token called “TrumpDollar” collapsed, losing investors $2 million overnight.

Imitation Tokens: Fraudsters create fake tokens that look like legitimate ones (for example, “TrumpCoin” vs. “DonaldTrumpCoin”).

D. Political Divide

Trump’s controversial persona restricts the appeal of these tokens to his loyal supporters. Negative news about him can lead to sudden sell-offs.

6. Cultural and Political Influence

Trump coins showcase wider trends in politics and cryptocurrency:

A. Memecoins Trend

These tokens fit into a broader memecoin trend (like Dogecoin and Shiba Inu), where viral community support often overshadows technical capabilities.

B. Political Contributions

Some projects claim to support pro-Trump organizations, but transparency is often lacking. For instance, “MAGA Coin” stated it would donate 1% of transactions to conservative charities, although proving such contributions can be difficult.

C. Centralization vs. Decentralization

While cryptocurrencies aim to spread out power, Trump coins tend to revolve around a singular figure, calling into question their alignment with the objectives of the crypto movement.

XRP ETF: The Potential, the Challenges, and What’s Next for Ripple

7. How to Buy Trump Coins (Safely)

For those looking to buy Trump-themed tokens:

Get a Crypto Wallet: Set up either MetaMask (for Ethereum) or Trust Wallet (for BSC).

Purchase BNB or ETH: Buy these currencies on exchanges like Binance or Coinbase.

Swap on DEXs: Link your wallet to PancakeSwap or Uniswap and trade for the token using its verified contract address (make sure to double-check!).

Check for Audits: Look for projects that have been audited by firms like CertiK or Hacken.

Be Cautious About FOMO: Only invest what you can afford to lose.

8. Final Thoughts: High Risk, Speculative Opportunities

Trump-themed cryptocurrencies are speculative investments that thrive on political sentiment and the excitement surrounding memecoins. While there’s a chance for quick profits, their lack of practical use, regulatory uncertainties, and dependence on Trump’s unpredictable image make them risky for most investors. Anyone considering jumping in should see these as high-stakes bets rather than long-term holds. As the crypto landscape evolves, these politically charged tokens may draw more scrutiny, possibly marking them as fleeting trends in a rapidly changing market.

Final Note: This overview is for informational purposes only. Cryptocurrencies can be volatile and often lack regulation in various areas. Always do your own research and consult with a financial advisor before investing.