1. Introduction

What is Raydium Coin (RAY)?

Raydium Coin (RAY) is the native utility token of Raydium, a decentralized automated market maker (AMM) built on the Solana blockchain. Unlike traditional AMMs, Raydium integrates with the Serum decentralized exchange (DEX), providing on-chain liquidity for fast and cost-efficient transactions. The platform enables users to swap, trade, and provide liquidity for various crypto assets in a decentralized manner.

Raydium stands out due to its ability to interact with Solana’s high-speed blockchain, processing thousands of transactions per second with near-zero fees. It allows users to participate in yield farming, staking, and governance, making it a key player in the DeFi (Decentralized Finance) revolution. With its hybrid AMM and order book model, Raydium enhances trading efficiency, reducing slippage and providing access to global liquidity pools.

Why is it important in the Solana ecosystem?

Raydium plays a crucial role in Solana’s decentralized finance (DeFi) ecosystem by offering high-speed, low-cost transactions compared to Ethereum-based AMMs. By integrating with Serum’s central order book, Raydium provides users with deeper liquidity, reducing slippage and improving trading efficiency. It is widely used in DeFi applications, NFT marketplaces, and GameFi projects within the Solana network.

As Solana grows in adoption, Raydium’s role in providing deep liquidity and efficient swaps makes it a cornerstone of the ecosystem. Developers are leveraging Raydium’s infrastructure to build new DeFi applications, decentralized exchanges, and yield optimization strategies, solidifying its place as a premier AMM on Solana.

2. Understanding Raydium Protocol

What is Raydium?

Raydium is a hybrid AMM and liquidity provider that allows users to trade assets seamlessly while contributing liquidity to decentralized pools. Unlike standard AMMs that rely solely on peer-to-peer liquidity pools, Raydium also taps into Serum’s order book, making it unique in the DeFi space.

Its dual approach enables users to access deeper liquidity, ensuring that large trades have minimal price impact. By merging AMM functionality with order book access, Raydium creates an optimal trading environment that benefits both liquidity providers and traders.

How does it work? (AMM, Liquidity Pools, and Order Book)

- Automated Market Maker (AMM): Users trade assets through liquidity pools instead of a traditional order book. Prices are determined algorithmically.

- Liquidity Pools: Users deposit assets into pools to facilitate trading and earn a share of transaction fees.

- Order Book Integration: Unlike standalone AMMs, Raydium interacts with Serum’s on-chain order book, allowing users to access global liquidity and better pricing.

- Yield Farming: Users can earn additional rewards by providing liquidity to specific pools.

- Staking: Investors can stake their RAY tokens to earn passive income while securing the network.

Role in the Solana Blockchain and Serum DEX

Raydium enhances the Solana blockchain’s DeFi infrastructure by:

- Offering fast and cheap swaps compared to Ethereum-based DEXs.

- Providing deep liquidity through its integration with Serum.

- Supporting yield farming and staking, enabling users to earn passive income.

- Enabling seamless participation in Solana’s NFT and GameFi ecosystem.

Raydium acts as a liquidity hub, supporting numerous projects within Solana’s ecosystem by offering initial liquidity offerings (ILOs) and launchpad services for emerging tokens.

3. The Raydium Coin (RAY) Explained

What is RAY?

RAY is the governance and utility token of the Raydium protocol, used for staking, liquidity mining, and governance proposals.

Utility and use cases of RAY

- Staking: Users can stake RAY to earn rewards.

- Liquidity Mining: Providing liquidity earns users additional RAY rewards.

- Transaction Fees: RAY is used for transactions within the platform.

- Governance: Holders vote on platform updates and decisions.

- Launchpad Participation: Users can invest in new Solana-based projects through Raydium’s AcceleRaytor.

How RAY is distributed and earned

- Liquidity providers earn RAY as a reward for contributing to pools.

- Stakers receive RAY as an incentive.

- Ecosystem grants fund development projects and partnerships.

4. Key Features of Raydium Coin (RAY)

High-speed and low-cost transactions

Built on Solana, Raydium transactions are processed in seconds with negligible fees.

On-chain liquidity and integration with Serum

Raydium enhances liquidity by linking with Serum’s order book.

Yield farming and staking opportunities

Users can farm RAY tokens by providing liquidity and stake them for additional rewards.

Ecosystem governance and decision-making

RAY holders can participate in governance to shape the future of the platform.

Multi-functional DeFi utility

Raydium also powers Solana-based NFT marketplaces, GameFi applications, and cross-chain liquidity solutions.

5. How Raydium Coin (RAY) Benefits the Crypto and DeFi Space

Role in DeFi, NFTs, and GameFi on Solana

- DeFi: Powers decentralized trading, staking, and liquidity mining.

- NFTs: Used in Solana-based NFT marketplaces for seamless transactions.

- GameFi: Supports play-to-earn gaming economies.

Enhancing decentralized trading efficiency

Raydium’s order book integration offers deeper liquidity and fairer pricing.

Comparison with other AMMs like Uniswap and PancakeSwap

- Uniswap: Ethereum-based, higher fees, and slower transactions.

- PancakeSwap: Binance Smart Chain-based, but lacks order book integration.

- Raydium: Solana-based, ultra-fast, and Serum-integrated.

6. Tokenomics & Supply of RAY

Total supply and circulating supply

- Total Supply: 555 million RAY.

- Circulating Supply: Varies based on staking and ecosystem rewards.

Staking, farming, and liquidity incentives

Users can earn passive income through various staking and liquidity programs.

Inflation and deflation mechanisms

A portion of trading fees is burned, controlling inflation over time.

7. How to Buy & Store Raydium Coin (RAY)

Best exchanges to buy RAY

- Centralized Exchanges (CEX): Binance, KuCoin, FTX.

- Decentralized Exchanges (DEX): Raydium, Serum.

How to store it (Wallets: Phantom, Solflare, Ledger, etc.)

- Phantom & Solflare: Best software wallets for Solana tokens.

- Ledger: Hardware wallet for added security.

8. Raydium Coin (RAY) Price Prediction & Market Performance

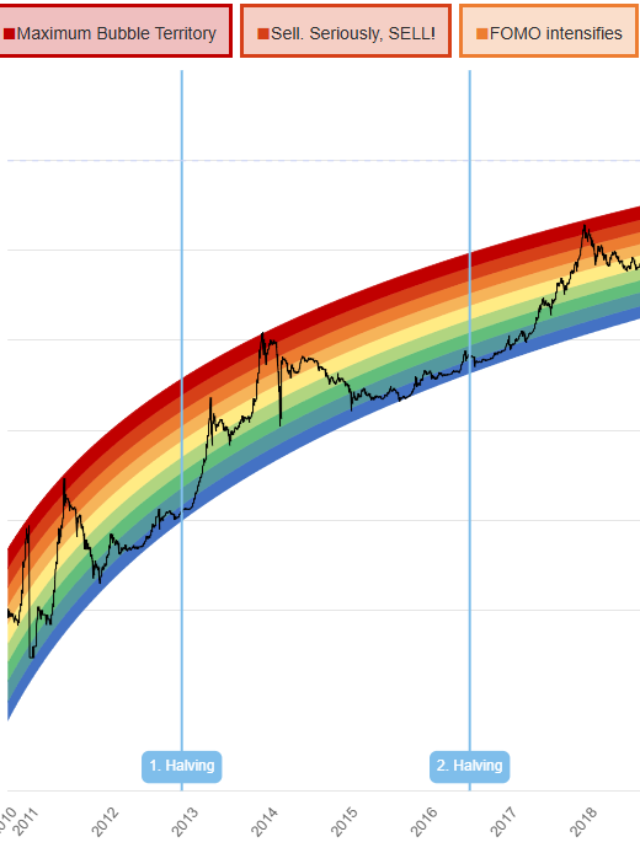

Historical price analysis

RAY has experienced significant fluctuations, reflecting overall DeFi trends.

Future price predictions based on market trends

Analysts expect RAY to grow as Solana’s DeFi ecosystem expands.

Expert opinions on RAY’s potential growth

Experts highlight its order book integration and high-speed transactions as key advantages.

Why President Donald Trump will host the White House crypto summit

9. Conclusion

Raydium is a fast, efficient, and cost-effective DeFi solution within Solana. With its low fees, deep liquidity, and integration with Serum, RAY has strong growth potential.