In a notable shift toward recognizing the evolving financial landscape, the White House recently referred to Bitcoin as “digital gold,” a term long used by cryptocurrency enthusiasts. This characterization, emerging from broader discussions on crypto asset regulation and economic strategy, underscores Bitcoin’s growing legitimacy as a store of value similar to precious metals. This article explores the implications of this acceptance, contextualizing it within economic, regulatory, and global frameworks.

What is “digital gold”?

The term “digital gold” compares Bitcoin to physical gold, emphasizing shared characteristics such as scarcity, durability, and decentralization. Both assets are mined, have a finite supply (bitcoin has a cap of 21 million; gold is physically limited), and serve as non-sovereign stores of value. The White House’s alignment with this analogy signals a subtle acceptance of bitcoin’s role in modern finance, despite previous regulatory doubts.

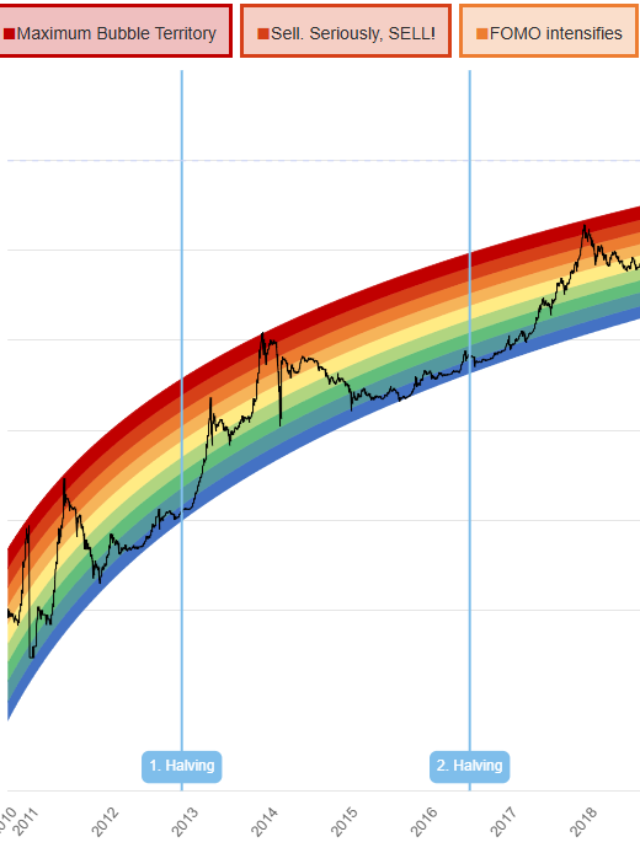

Rarity and Store of Value

Bitcoin’s algorithmic rarity mirrors gold’s natural limitation, fueling its perception as a hedge against currency devaluation. Unlike fiat currencies, which central banks can inflate, bitcoin’s supply predictability attracts investors seeking protection against macroeconomic volatility. The White House’s tacit support here may reflect concerns about inflation and debt-driven economies, positioning bitcoin as a contemporary alternative to traditional safe havens.

Hedge against Inflation

In an era of global inflationary pressures, bitcoin’s comparison to gold takes hold. The US administration’s recognition signals an understanding of crypto’s role in diversified portfolios, especially as millennials and institutions are increasingly adopting digital assets. However, bitcoin’s volatility – a stark contrast to gold’s stability – remains a significant caveat, potentially undermining full-throated government support.

Regulatory implications

Labeling bitcoin as digital gold could mark the beginning of a clearer regulatory framework. The U.S. has been grappling with classifying cryptocurrencies, affecting taxation, securities law and banking integration. This acknowledgement could speed up efforts to regulate bitcoin separately from other cryptocurrencies, potentially easing the path for a bitcoin ETF or retirement investment. Still, the administration has also emphasized stricter oversight to combat fraud and ensure market stability, as seen in recent SEC actions.

Environmental concerns

The White House’s stance is not without reservations. Bitcoin’s energy-intensive proof-of-work mechanism has drawn criticism, particularly from environmentally conscious policymakers. The administration has likely balanced its “digital gold” push with calls for sustainable mining practices. Initiatives like the Crypto Climate Accord, which promotes renewable energy transitions, align with US climate goals and could shape future regulations.

Global context and geopolitics

Globally, recognizing Bitcoin as digital gold dovetails with geopolitical strategies. While China has banned crypto mining, the US is set to use blockchain innovation to maintain technological leadership. Emerging markets like El Salvador’s Bitcoin adoption challenge the dollar’s hegemony, potentially influencing US policy to integrate digital assets into its economic toolkit, ensuring competition against central bank digital currencies (CBDCs).

Market reactions and expert opinions

The administration’s comments have buoyed crypto markets, bolstering investor confidence. Supporters applaud the recognition, hoping for institutional inflows, while critics warn of overvaluing an asset still prone to speculative fluctuations. Experts suggest this approval could boost Wall Street adoption, connecting traditional finance and the crypto ecosystem.

Challenges and criticisms

Despite the optimism, challenges remain. Bitcoin’s volatility undermines its reliability as a short-term store of value. Security issues, such as exchange hacks, and regulatory actions on other cryptocurrencies (for example, SEC lawsuits against altcoins) highlight the risks. The White House likely views bitcoin through a bifocal lens: a pioneering asset that has promise but needs guardrails.

Future Outlook

Looking ahead, Bitcoin’s trajectory may depend on regulatory clarity, technological advancements (e.g., Lightning Network for scalability), and environmental improvements. The potential approval of a spot Bitcoin ETF could democratize access, while CBDC development could coexist with or challenge Bitcoin’s role. The White House’s nuanced stance—a blend of recognition and caution—may set the stage for Bitcoin to mature into a cornerstone of digital finance.

Conclusion

The White House’s “digital gold” metaphor represents a key moment in Bitcoin’s journey from a niche asset to mainstream recognition. While challenges remain, this acceptance represents a broader shift toward integrating digital assets into economic paradigms. As the US pursues this transformation, balancing innovation with risk management will be critical in shaping a resilient financial future. Bitcoin, as digital gold, stands at the intersection of tradition and innovation, reflecting the complexities of a digital world.

2 thoughts on “White House Recognizes Bitcoin as “Digital Gold”: Implications and Insights”